Based on current prices, these three stocks will generate high dividends for investors looking for passive income.

Based on the prices and dividends at the time of this writing, the average dividend per share is i Vitesse Energy (VTS -0.41%)the JPMorgan Equity Premium Income ETF (YEEP -0.22%)and Whirlpool (WHR -0.97%) is 7.8 per cent. All three are attractive, but all involve risk. Before you add these three stocks to a high-yield portfolio, here’s what you need to know.

Vitesse Energy (yield of 9.1%)

Vitesse is an oil and gas exploration and production company with a difference. Instead of owning and operating assets, it focuses on investing in minority interests in assets produced by other leading companies. In addition, management follows a discretionary strategy of hedging some of its oil production to protect downside risk of a drop in the oil price.

It is an attractive model because it focuses the company’s value creation activity based on what management does best – acquiring productive interests in oil wells and then generating cash flows from oil and gas production.

That said, it makes sense to look at the risks. First, as mentioned, the hedging strategy is discretionary, so you are always somewhat dependent on management’s ability to hedge appropriately. Second, a significant drop in the price of oil will still hurt Vitesse Energy, as it will make the production of oil less cost-effective for oil producers. Third, management may not be able to identify value-adding acquisitions.

All in all, Vitesse is attractive to investors who are optimistic about oil and those who are happy with the price around the current mark. Additionally, if you have confidence in the management team led by industry veteran Bob Gerrity, then Vitesse is an excellent stock to add to a diversified income-producing portfolio.

JPMorgan Equity Premium Income ETF (6.8% yield)

The first important point to understand about this ETF is that it invests at least 80% of its assets in actively managed US stocks – meaning it gives investors exposure to the US stock market and the dividend yield generated by the stocks it owns.

Image source: Getty Images.

Second, it invests up to 20% of its assets in the purchase of equity-linked notes (ELNs), which sell out-of-the-money call options on S&P 500which is a hedge against volatility and significant share falls. It’s worth noting that this allows the ETF to capture a premium when the S&P 500’s performance is negative per month or rises moderately, but the ETF will lose money on the ELNs in a sharply positive month for the S&P 500.

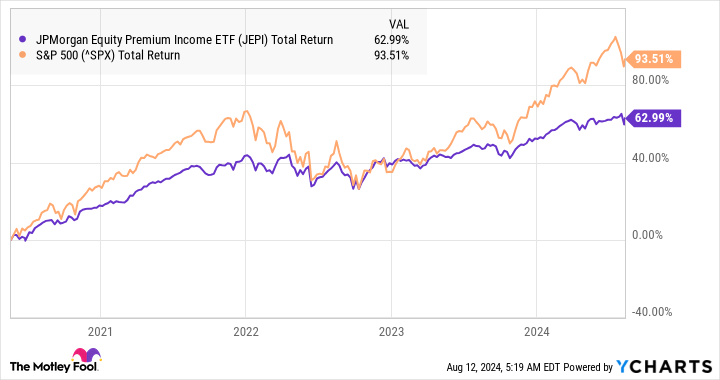

In a nutshell, you can expect the ETF to be positive but to underperform the market in strong rising markets (but still deliver good income) as the increase in share value will be offset by losses on the ELN strategy. Still, the ETF’s downside is protected when stock markets fall due to the ELN strategy.

The fund’s sweet spot is an environment of moderately rising equity markets that provide opportunities for dividend income, premiums from the ELN strategy and capital appreciation from equities.

This is confirmed by looking at its track record.

JEPI Total Return Level data by YCharts

Overall, it is a good option for investors looking for monthly income and those concerned about the downside risk of the stock market.

Whirlpool (yield of 7.5%)

This company faces significant short-term risks, but has plenty of long-term opportunities. The persistence of relatively high interest rates and an accompanying slowdown in existing home sales is having a negative impact on consumers’ discretionary purchases of major household appliances (MDAs).

That’s holding back MDA sales in North America and squeezing profit margins, as discretionary purchases can be higher margin (think planned kitchens) compared to lower-margin replacement demand for items like refrigerators and washing machines. As such, management lowered its full-year margin, earnings and cash flow guidance on its last earnings call.

If Whirpool’s ultimate market conditions deteriorate further, its dividend could be affected, or at least its plans to reduce its $6.3 billion in long-term debt would be pushed back.

On the other hand, management believes its price increases in the spring helped the North American MDA segment’s profit margins improve to 6.3% in the second quarter, compared to 5.6% in the first quarter. Management also expects North America MDA to end the year with 9% margins.

Additionally, the other three segments (responsible for 38% of segment profit in the second quarter) all grew year-over-year earnings in the second quarter.

Image source: Getty Images.

The stock’s upside comes from a potentially better interest rate environment ahead and a recovery in the housing market, though it may not start until 2025 at the earliest. Until then, Whirlpool will have to scramble. It could get worse before it gets better, but the stock looks like a good value at a trailing price-to-earnings ratio of less than 10.