- The Japanese yen has seen significant volatility in recent weeks, influenced by factors such as a rebound in the US dollar and mixed Japanese economic data.

- USD/JPY shows potential to retest the 150.00 level with resistance at 146.37 and support around 143.60.

- EUR/JPY is mirroring USD/JPY’s moves with resistance at 163.50 and the potential for a 200-pip rally if it breaks the 200-day MA.

JPY Basic Overview

The Japanese yen has had a wild ride over the past few weeks with yen pairs experiencing whipsaw price action. Things are settling down recently, but the potential for further headwinds still exists.

The US dollar is seeing a slight recovery this morning, which has helped USD/JPY push away from the psychological 145.00 handle. This comes after the pair saw significant volatility yesterday following downwardly revised jobs data and Fed minutes releases.

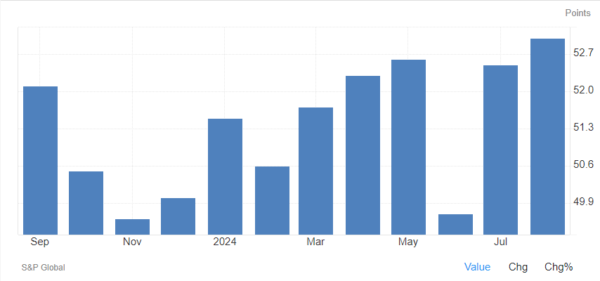

A number of Japanese data were released in the Asian session to a mixed reception. Composite and Manufacturing PMI rose higher from a month earlier. The composite print was the highest print since May 2023.

Japanese Composite PMI hits highest level since May 2023

Source: Trading Economics (click to enlarge)

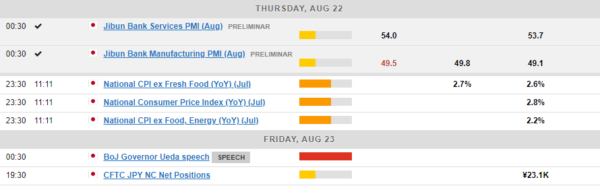

au Jibun Bank Japan Manufacturing PMI rose to 49.5 in August 2024 from a four-month low of 49.1 in the previous month, compared with market forecasts of 49.8, pointing to the second straight month of decline in factory activity, showed preliminary estimates. It also marked the sixth straight month of decline in the manufacturing sector this year as new orders fell further as foreign sales fell at a stronger pace.

Finally, data for business confidence also showed marginal signs of improvement.

Bank of Japan’s Kazuo Ueda is due to testify before Japan’s parliament on Friday, where lawmakers will scrutinize the central bank’s July rate hike. In addition, local inflation figures are scheduled to be released tomorrow.

The week ends at the Jackson Hole Symposium, which focuses on central bankers from both the US and the UK. Jerome Powell and Andrew Bailey are both expected to make remarks which could increase volatility and affect USD/JPY and GBP/JPY ahead of the weekend.

Technical Outlook for Japanese Yen

USD/JPY

From a technical perspective, USD/JPY’s recent price action saw a green daily candle, ending a 3-day losing streak. Although USD/JPY failed to test the 150.00 level at the end of last week, there is potential for another attempt at this psychological threshold.

Today’s daily light is on track to complete a morning star constellation pattern from a key support area, theoretically signaling higher prices. However, with the upcoming inflation figures in Japan, the Jackson Hole Symposium and BoJ Governor Ueda’s parliamentary appearance, risks remain significant.

On the upside is resistance at 146.37, tested earlier today. A break above this could shift focus to last week’s highs of 149.38. Conversely, a break of the 145.00 level could open the way for a retest of the August 5 low at 141.67, although USD/JPY will first have to navigate support around the 143.60 handle.

USD/JPY Daily Chart – August 22, 2024

Source: TradingView.Com (click to enlarge)

EUR/JPY

EUR/JPY closely mirrors the USD/JPY chart, a trend that has become more apparent in recent months. Yesterday EUR/JPY formed an inverted hammer and this morning’s brief push higher encountered resistance near yesterday’s highs.

Immediate resistance is at 163.50, with the 200-day moving average just above 164.13. A break of this level could trigger a 200-pips rally towards the 166.21 handle and 100-day moving average.

On the downside, a move lower from current prices would need to navigate the 162.00 level before bringing the psychological 160.00 handle into focus.

EUR/JPY Daily Chart – August 22, 2024

Sosource: TradingView.Com (click to enlarge)