Cash back cards generally fall into one of three categories:

- Fixed rewards such as 2% cash back on every purchase.

- Rotating category rewards, such as 5% cash back on a selection of purchase categories updated quarterly, then 1% cash back on remaining purchases.

- Fixed category rewards such as 6% cash back on groceries, 3% cash back on gas or 2% cash back on restaurant purchases, then 1% cash back on remaining purchases.

The best type of cash back card will vary depending on your buying habits. If you have a large amount of purchases in a certain category, such as groceries or gas, it makes sense to find a card that offers bonus cash for your frequent purchases. But if you want a “set it and forget it” card, a cash back card will probably make more sense for you. If you want to maximize your cashback earnings, consider pairing a fixed rate card with one that offers a bump where you shop most often.

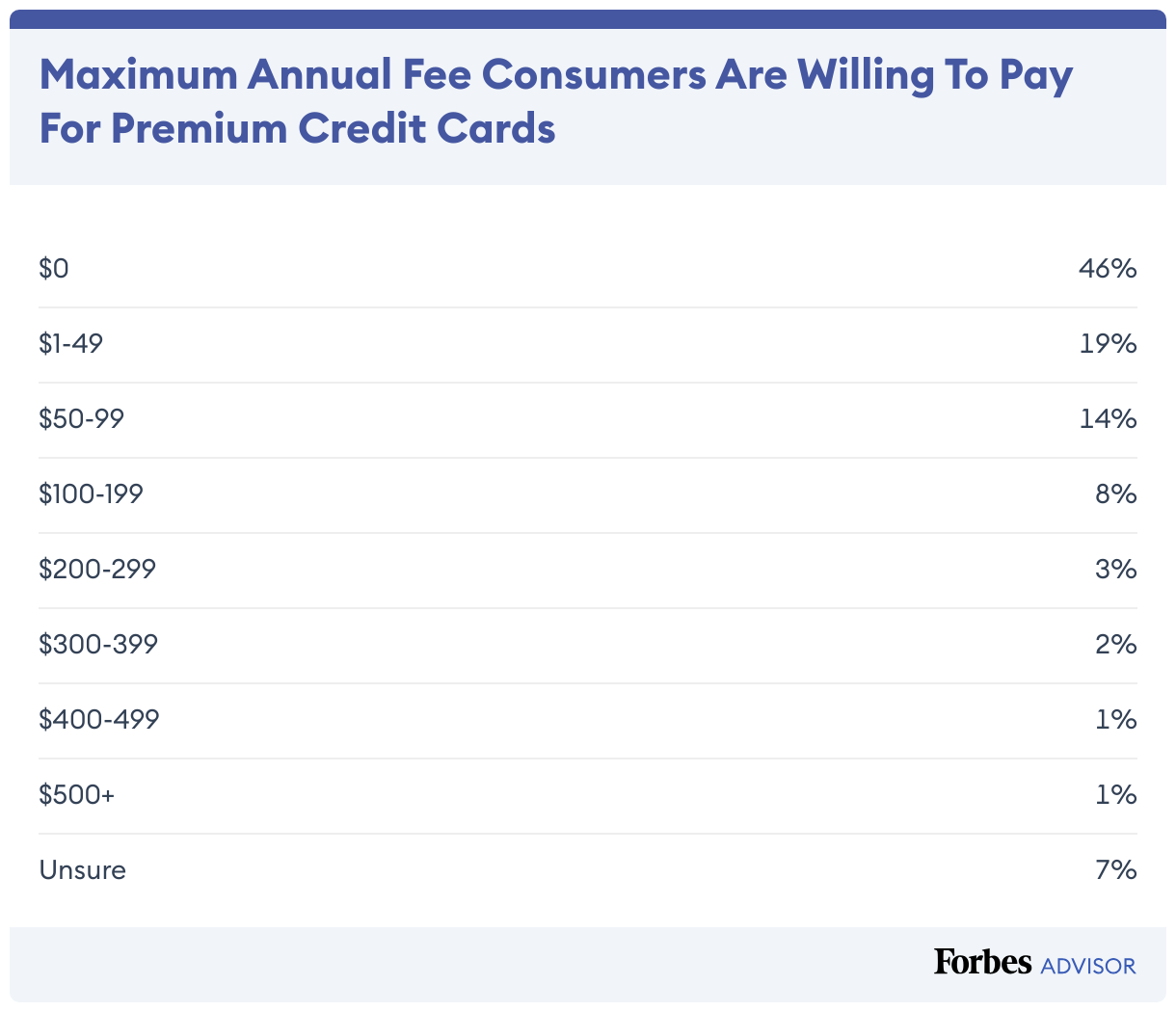

Survey: Many Americans don’t want to pay annual fees for credit cards

Many of the most advertised credit cards come with annual fees, but they’re not your only option. There are plenty of credit cards with no annual fees – matching the preferences of 46% of Americans, according to a survey for Forbes Advisor conducted in July 2024. When consumers consider paying annual fees for credit cards, the lower the better.

Fortunately, there is a wide collection of credit cards that offer cash rewards, even if you don’t want the expense of an annual fee. Consumers can choose between fixed cash back options, cards with bonus categories or those with rotating offers. And those most dedicated to maximizing rewards can use multiple cards to take advantage of each card’s different benefits. By carrying two or three cards, you can earn incredible rewards, even without resorting to cards with an annual fee.

Visit this page to see prices and fees for the Blue Cash Preferred® Card from American Express.

¹Eligibility and benefit level varies by card. Terms, conditions and restrictions apply. Visit americanexpress.com/benefitsguide for more details. Guaranteed by AMEX Assurance Company.

²Eligibility and benefit level varies by card. Terms, conditions and restrictions apply. Visit americanexpress.com/benefitsguide for more details. Guaranteed by AMEX Assurance Company. Car rental loss or damage coverage is offered through American Express Travel Related Services Company, Inc.