The chairman of the US central bank, Jerome Powell, in Washington on July 31, 2024 (AFP / ROBERTO SCHMIDT)

“The time has come”: With these words, the president of the US central bank (Fed) Jerome Powell gave the signal that the markets were waiting for on Friday in Jackson Hole (Wyoming), opening the door wide open for a first rate cut during the next meeting in the institution, 17 and 18 September.

“The time has come for an adjustment in monetary policy,” the head of the US Federal Reserve assured in a much-anticipated speech at a symposium gathering mainly US central bankers in Jackson Hole.

“The direction to be taken is clear, the pace of rate cuts will depend on future data, the evolution of the outlook and the balance of risks” between maintaining full employment and controlling inflation, Jerome said.

His “confidence has increased that inflation is on a sustainable path back to 2%”, the target set by the central bank’s mandate.

In the highly codified language of central banks, this is really a signal that the Fed Monetary Committee (FOMC) will cut its interest rates at its next meeting, in mid-September, the last before the holding of the US presidential election on November 5.

A television screen broadcasts on the floor of the New York Stock Exchange (NYSE) in New York, August 23, 2024, the speech of Fed President Jerome Powell in Jackson Hole, Wyoming (AFP / ANGELA WEISS)

Mr. Powell’s regular speeches had so far given no indication of the possibility of a rate cut by the Fed, an action that was only expected by markets in the first half of the year before persistent inflation makes them hope for September.

On Wednesday, the publication of the Fed’s “minutes”, the report from the previous meeting, had already mentioned this possibility: “the vast majority (of members, editor’s note) emphasize that if the data continues in the expected direction, it would probably be appropriate to ease (monetary) policy at the next meeting,” it read.

– Rising unemployment –

“We will do everything in our power to support a solid labor market,” Jerome Powell also assured Jackson Hole, a sign that employment is returning to the institution’s radar while the pace of job creation returns to the level it was before the pandemic.

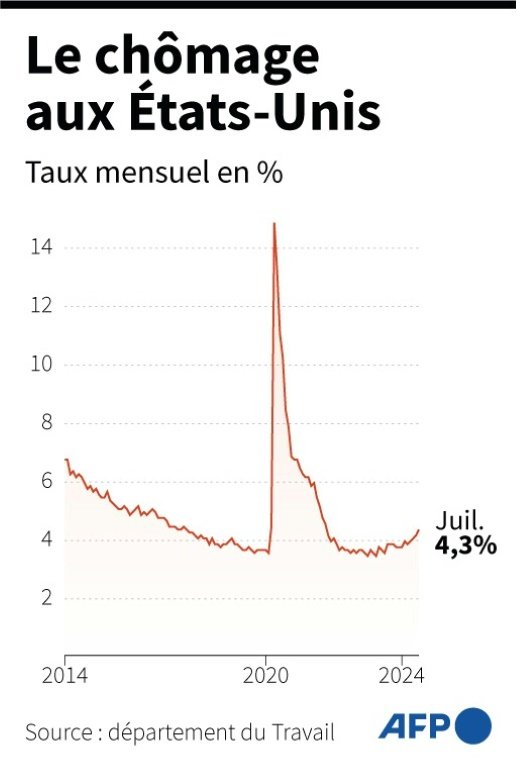

Graph showing unemployment in the US (AFP / Samuel BARBOSA)

“There is a good chance that the latest data has strengthened + the doves + (more concerned about labor market developments and supporters of a flexible monetary rate, ed. note) and reassured + the hawks + (more focused on the issue of inflation and supporters of monetary orthodoxy, editor’s note) within the institution,” Pantheon Macroeconomics chief economist Ian Shepherdson assessed in a note.

Wednesday’s revision of job creation in the past financial year – the largest revision carried out since 2009 – showed that the labor market was indeed in an advanced phase of slowdown.

The data published so far had overestimated by more than 800,000 the number of jobs created in the United States between the beginning of April 2023 and the end of March 2024.

“This highlights a still positive pace” of job creation, but “much more moderate than originally anticipated. The nuance is important because it emphasizes to economists as well as to policymakers that the economy continues to develop, but at a more moderate pace. ” said EY chief economist Grégory Daco interviewed by AFP.

– “Risk balancing” –

So far, data has shown a gradual slowdown in job creation, but with the relative increase in unemployment to 4.3% at the same time, there is now a risk that the latter will once again become a big issue.

A television screen broadcasts on the floor of the New York Stock Exchange (NYSE) in New York, August 23, 2024, the speech of Fed President Jerome Powell in Jackson Hole, Wyoming (AFP / ANGELA WEISS)

Fed officials are also emphasizing “a rebalancing of risks associated with inflation and employment,” according to the minutes.

The rise in unemployment has particularly worried the markets, which fear that the “Sahm rule” is not yet true: According to this, the US economy enters recession when the unemployment rate rises by an average of 0.5 percentage points over three months.

The increase in July was 0.53 points compared to the previous month.

All analysts now expect a rate cut in September, with the majority seeing it at 25 basis points (bps), but almost 40% of them seeing it at 50 bps.