I’m a big fan of using dividend stocks as a way to earn extra income. But not all dividend-paying companies are reliable. Vodafone recently disappointed me by halving its 10% return, prompting me to sell my stake in the company.

Now I’m more careful about the income stocks I invest in. Currently my top three picks are Phoenix Group (LSE: PHNX), British American Tobacco (LSE: BAT) and Legal & General (LSE: LGEN).

Here’s why I think they’re worth considering as investors.

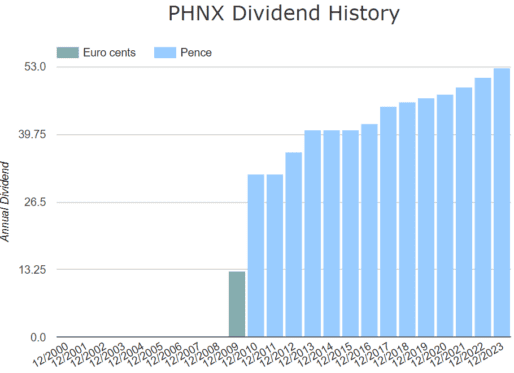

Phoenix Group

Phoenix Group’s yield of 9.5% may soon be the highest on FTSE 100 after Vodafone falls to 5.2 per cent. The insurance company has not paid dividends for very long, but has increased them annually for the past six years.

As one of the UK’s largest insurers, it faces stiff competition from Legal & General and Caution. Unfortunately, there is one glaring problem, it is currently unprofitable. Years of low earnings have also pushed up its debt, which is now nearly double its equity.

It doesn’t sound very promising.

But a recent boost in revenue helped push the company back toward profitability. It is likely to become profitable again next year, with earnings potentially reaching £280m. by the end of 2025.

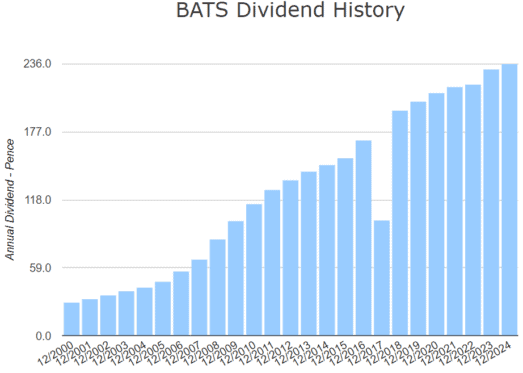

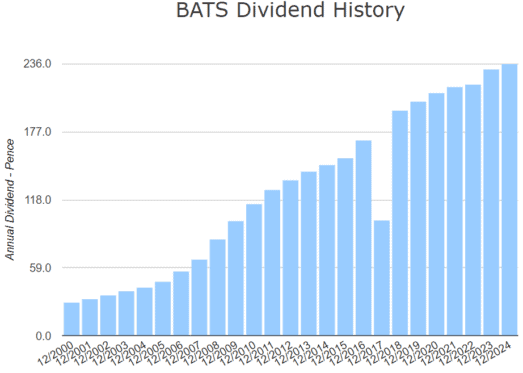

British American Tobacco

With a dividend yield of 8.5%, British American Tobacco could soon be the fourth highest FTSE 100 dividend after Burberry cut its dividend. Apart from a brief reduction in 2017, it has provided a reliable and increasing dividend for over 20 years.

Currently, it is unprofitable, but the expected earnings growth gives it a forward price-to-earnings (P/E) ratio of 8.3. And with future cash flows expected to increase, the shares are estimated to be undervalued by nearly 60%.

But tobacco is a dying industry, so it’s hard to have too much faith in the company’s long-term prospects. Not to mention the moral implications.

However, British American Tobacco is focused on switching to tobacco-free products as tighter regulations threaten the bottom line. Its Vuse product is the most popular vaping brand in the world, according to the company. It is actively advocating for stricter regulations and bans on single-use vapors and child-attractive flavors to help reduce underage smoking.

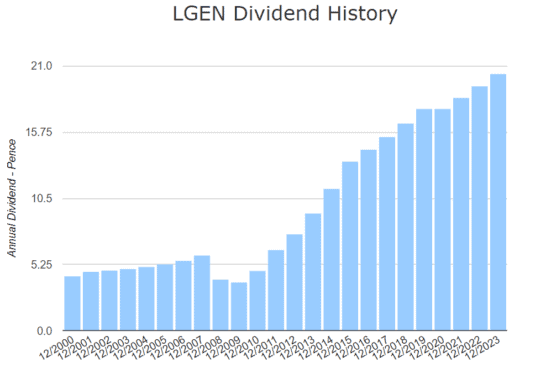

Legal & General

At 8.9%, Legal & General is the third highest return on the FTSE 100, slightly below other insurers M&G. But as a purely income-focused stock, it doesn’t offer much price growth. It has only risen 1.6% in the past five years.

However, payments are super-reliable, having risen consistently since 2009 with only a short break in 2020. Its dividend boasts a compound annual growth rate (CAGR) of 13.3%, and the dividend is expected to reach 10% in the next three years.

Like Phoenix, low earnings have pushed its P/E ratio up to 48 and left it with a lot of debt. If forecasts are correct, improved earnings could bring it closer to the industry average of 11. But with a debt load of twice its market value, it has a long way to go.

If it weren’t for the spectacular track record of paying dividends, I’d probably give it a miss. But in this case, I think the reward is worth the risk.

The post Do you want to make money through passive investing? Here are 3 top dividend stocks to consider and appeared first on The Motley Fool UK.

More reading

Mark Hartley holds positions at British American Tobacco Plc, Legal & General Group Plc and Phoenix Group Plc. The Motley Fool UK has recommended British American Tobacco Plc, Burberry Group Plc, M&g Plc, Prudential Plc and Vodafone Group Public. The views of the companies mentioned in this article are the author’s and therefore may differ from the official recommendations we provide in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool, we believe that considering a wide range of insights makes us better investors.

Motley Fool UK 2024