Is your investment return good or bad?

Do you know how well your investments are doing?

Do you wonder if a return of 10% is good or bad?

Do you know the annual return on your investments?

What about how well your investments are doing compared to a standard benchmark?

Ever since a friend asked me to look over her investments and tell her if she is doing well, I have wanted to help investors answer this question;

“What is a good return and what is a bad return?”

Most individuals do not know if their return on investment is good or bad. Even investors with financial advisers do not know how to evaluate their returns. Many financial advisers do not offer their customers the annual return on the investment portfolio compared to the return of non -managed indices. And that’s a big problem.

You hire a financial advisor to help you manage your money and get a good annual return on investment. But if you don’t know your annual return, or even if you do, you still need to know if this return is good or not.

When managing your own finances, you need to know if you are also making the best investment decisions.

What is a return rate?

Your investment rate is the return is the percentage increase or decrease in the value of your investment, typically over a period of one year.

If you invest $ 1,000 on January 1st and at the end of the year your investment value is $ 1,100, then you have earned a 10% return.

To calculate your return percentage, use this formula or an online calculator.

Return rate = [(New value of investment – Original value of investment)/Original value of investment] x 100

Return rate =[($1,100 – $1,000)/$1,000] x 100 = 10%

What is a good return?

The answer is – it depends.

Whether a return is good or bad is relative.

Generally, because stocks are more risky, they typically offer higher returns than bonds. Since bonds tend to be safer, they will offer lower returns.

From 1928 to 2019, the S&P 500 – a power of attorney turned to the US stock market – over 9% annually. And during the same period, the 10 -year -old US government bonds returned almost 5%.

So using historical share and bond return as a guide you may consider that a stock market of 9% and a bond return of 5% is a good return.

But there is much more to evaluate the return on investment than just matching a long -term average.

What is a good return on investment? – Video

What is a bad return?

Using the example above, you may think that a poor return would be a return that is lower than the average for the category.

So if your stock market portfolio returned 5% and your bonds 3%, you might think your investment portfolio failed and earned a bad return. But that is not necessarily true.

A 9% return on your stock portfolio can be considered bad during a year in which the S&P 500 index earned 13%.

In contrast, a 5% return on your share portfolio can be a good return if the S&P 500 lost 4% over the same year.

Is a 10% return good or bad?

Think of Keisha. She was excited in January when her advisory-controlled investment portfolio All-Stock portfolio gave back 10% over the previous year. She knew her bank savings account was not earning much, so she welcomed what looked like an overwhelming 10% return.

Here’s the reason why Keisha should have been disappointed – even though her stock portfolio struck the long -term historic stock average.

At the same time, it did not return -S&P 500 index 13.48%. Suddenly Keisha’s 10% return doesn’t look too good. She thought, why do I pay my investment advisor 1% to manage my stock portfolio for a lower return than the non -managed S&P 500 index fund?

That’s a legitimate question.

Here is how Keisha could have come close to a 13.48% return the same year, thereby fighting the return by his investment manager by 3%.

Whether your return is good or bad depends on whether you could have received a better return with the same risk. And Keisha could have earned a better return, saved money on his investment fees with the same or less risk.

Passively managed index funds is the way of investing

Years of investment surveys, Warren Buffett, John Bogle and the Nobel Prize winners agree that most investors would make it good to invest in a portfolio of passively managed index funds.

An index mutual or stock exchange fund is a passive investment. It simply mimics the investments in a basket or index of shares (or bonds). The S&P 500 index is one of the most popular indices and has a market value weighted group of large US companies. This index is often used to reflect the complete US stock market.

You can buy shares in a fund that reflects the S&P 500 index. If you choose to buy index funds for your investment portfolio, your return on investment will make that index.

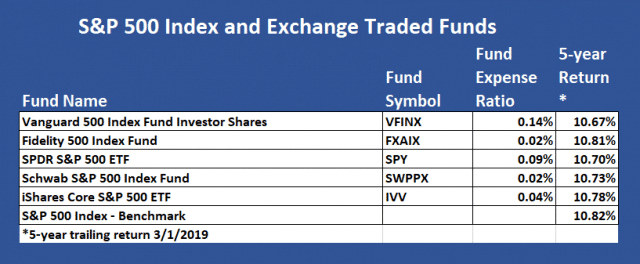

The following are several low fees S&P 500 index mutual and stock -traded funds (ETFs).

Note that the return is the same, with the fidelity, low fee fund that gives the highest 5-year return.

When you invest in a non -administered index mutual or stock exchange fund, your returns are slightly smaller than those in the actual index. The difference in return between the fund return and the index is typically explained by the expense ratio.

While it is wise to invest in a low fee, passively administered index funds, I would not worry about hundreds of a percentage difference in fees or returns.

Is 10% a good or bad return? The answer is, it depends.

In Keisha’s case, since her adviser invested in a diverse portfolio of US shares, and her return was good under the S&P 500 index return that year, 10% was not a good return. If she had forgotten the counselor and invested all her stock investment portfolio in one of the above -mentioned S&P 500 index funds, her return would have been closer to 13.40%. (13.48% index returns less a fund fee of 0.09%)

Find out if you get a good or bad return

Don’t look at your return on investment in a vacuum. The return is only meaningful in light of potential returns available for similar investments.

You would not compare the return on your All Stock portfolio with the annual return on a 50% stock and 50% bond portfolio. This is because bonds typically offer a lower return than stock investments.

Here is a simple approach to finding out if your investment portfolio is getting a good return or not. The goal is to match or beat a non -administered index invested in a comparable asset allocation.

You use a benchmark to compare assess your returns because it is an attainable return. Despite how easy it is to invest in a market-matching index fund when most investors do not reach that benchmark.

Click here for free microbog to invest and surpass + wealth tip newsletter

Follow these steps to find out your investment return:

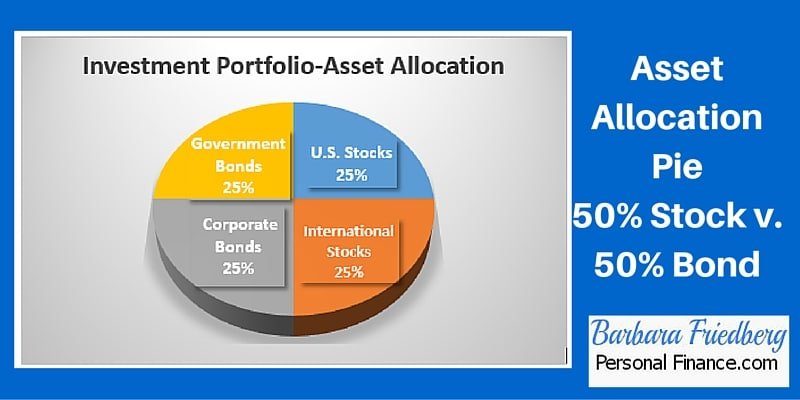

1. Create your Asset Allocation PIE. What percentage of your assets (or assignment of asset) are in shares, bonds and cash? You may need to drill further into different types of investments. For example, if you want to go into depth, you can investigate that the percentage of your overall investment assets is in major capitalization of US equities, developing the market’s international shares, new market stock, values US equities, small capitalization stock, etc.

When you create your asset allocation spai, next move on to the regular part of your portfolio. Do you have a US Bond Fund, Commercial Fund, Government Beligion Fund, etc.?

The next step is a job for you or your financial adviser.

2. Find out which index funds relate to your asset allocation. In other words, your individual shares, bonds and/or funds categorize according to type. For example, imagine that your investment portfolio-current allocation of pie looks like this:

In each of these categories you may have individual shares and/or mutual funds that fit the category.

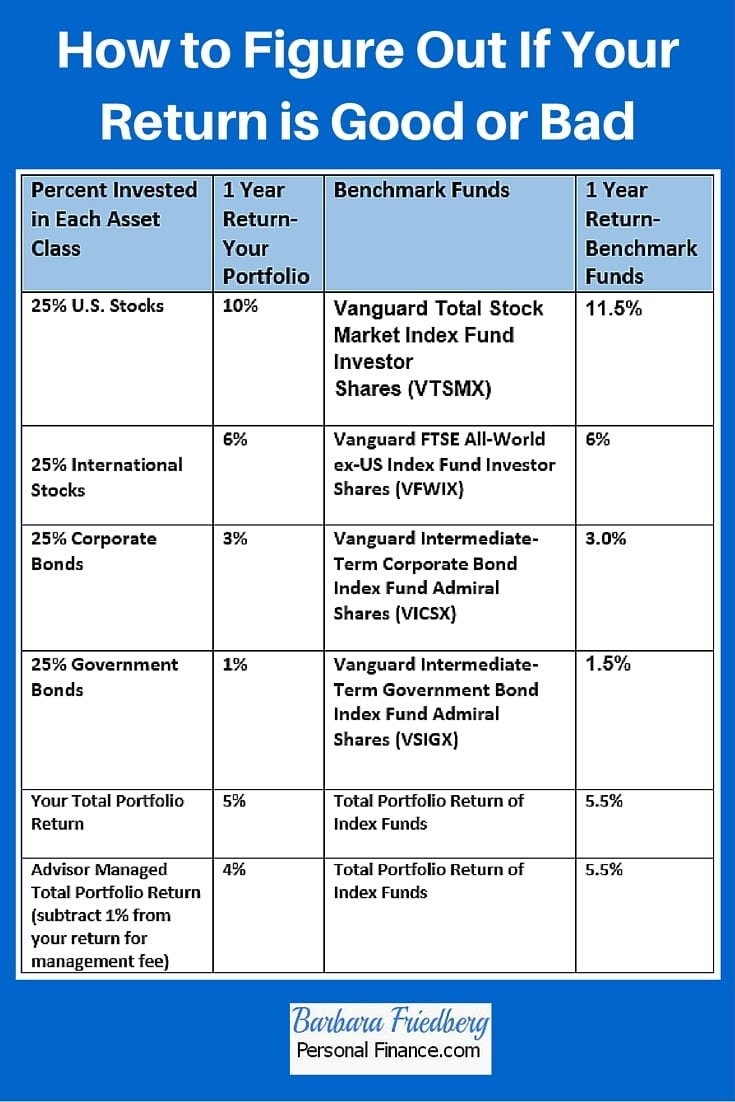

3. Calculates the return on each of your asset classes and indicate them together with the percentage invested in each asset category.

How to calculate the return on your portfolio:

Your annual portfolio return is 5%. [(.25 * .10) + (.25 * .06) + (.25 * .03) + (.25 * .01)]

Now you know that your one year’s return on investment is 5%.

4. Compare your returns with the return of a benchmark portfolio.

But how do you know if this is a good or bad return?

As we discussed earlier, you know if you get a good return if your return is equal to or better than your portfolio’s comparison benchmark. Since you know your pie for allocation of active, all you have to do is find out benchmark returns.

The following are the hypothetical benchmark returns compared to your returns:

Did you get a good or bad return?

Now you are equipped to answer this question. You invested in stocks, bonds and funds, and your annual return was 5%. Had you gone the light route and chose 4 index funds, in the desired asset allocation, you would have beaten your own return by 0.5% a year. Your stock picking effort was not rewarded.

Imagine that if you had hired a portfolio manager who diversified your investment portfolio, invested in a broad mix of shares, bonds and mutual funds and got a 5% return. But the manager’s fee was 1% and was subtracted from 5% return. Now your adviser administered Fund only 4% (5% -1% fee).

Compare your 5% return or advisor administered 4% return with 5.5% index fund portfolio return. The non -managed index fund portfolio exceeded both your own and the advisor managed investments. The results are clear, the passively administered portfolio of index funds exceeded your own and the advisor administered investments.

Is that always the case? You do not know unless you or your advisor compare your investment portfolio with the comparable benchmarks.

You decide whether your return is good or bad. The best way to answer this question is to compare your own return with the returns you may have received on a comparably passively administered index fund portfolio.

If you would like a free investment manager who offers thousands of funds and shares, you may want to consider investing with M1 Finance.

Related

- What should i invest in if i’m in a high tax class

- 4 best investment leaders to see

- How to save for retirement at 30 and become a millionaire

Disclosure: Note that this article may contain affiliated links which means That – to zero costs for you – I can earn a commission if you sign up or buy through associated link. That said, I never recommend anything I don’t think is valuable.