Key takeaways

-

The Apple card offers 3 percent daily cash back on Apple purchases and selected retailers, 2 percent on Apple Pay purchases and 1 percent on all other purchases.

-

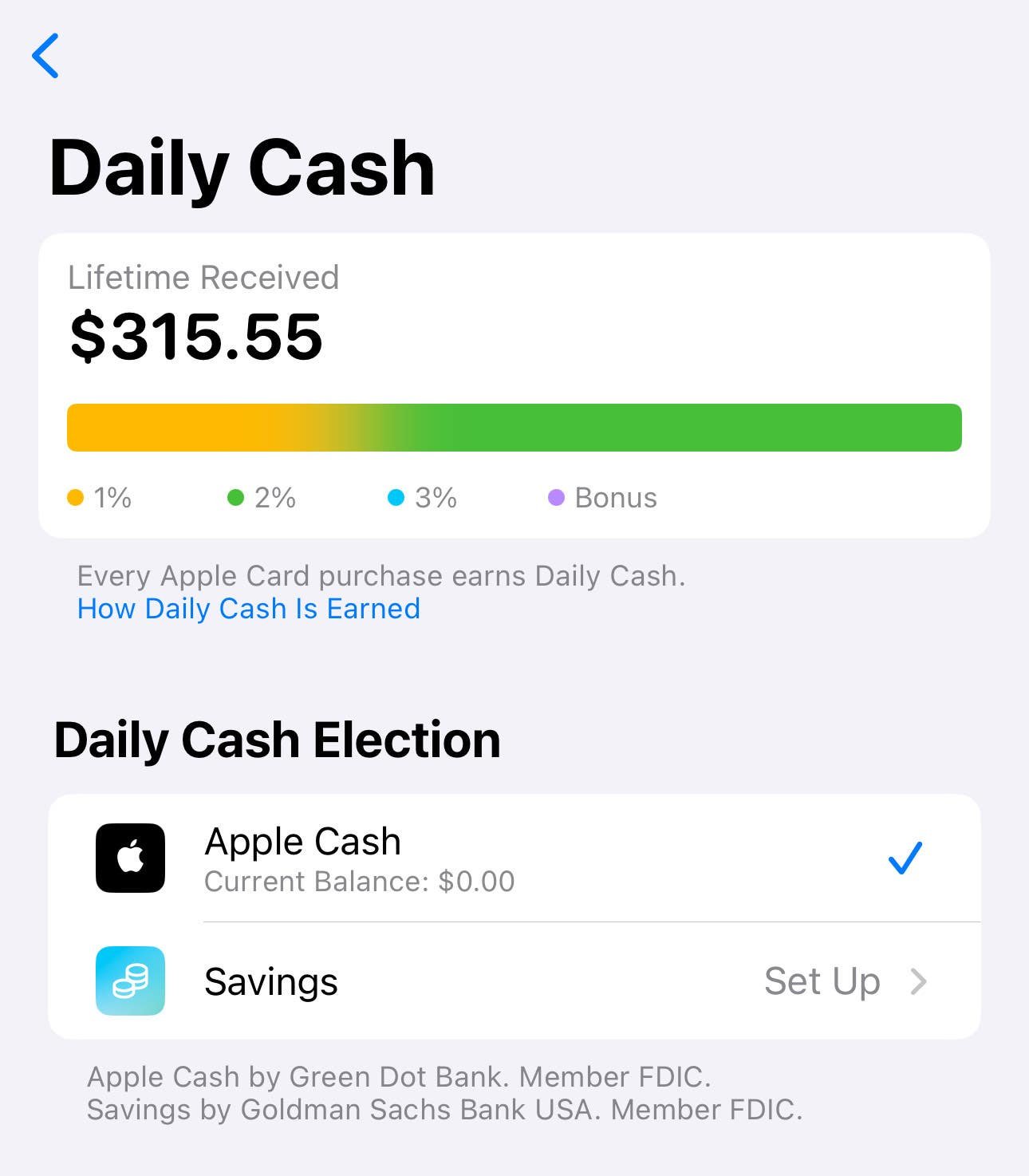

Your cashback rewards are earned in the form of daily cash, which you can choose to collect at the Apple Cash spot in the Wallet app or to deposit into an Apple HYSA.

-

You can manage your Apple Card and daily cash directly from your Apple Wallet.

The Apple Card* promises the ability to earn cash back on everything you buy, including Apple purchases, with no annual fee. However, the cash back you get with this card works differently than it does with a traditional cashback credit card.

With the Apple Card, you earn daily cash that accrues every day (as opposed to at the end of a statement period, as is typical with reward cards) and can be redeemed with other funds you have in your Apple Cash account.

Before you sign up for the Apple Card, though, it helps to understand how the rewards program works and the redemption options you may be eligible for to decide for yourself whether it’s worth it.

Basics of the Apple Card program

The Apple Card comes with no annual fee, no foreign transaction fees and no late fees, as well as a tiered rewards program that gives you up to 3 percent back on some purchases. How the rewards program works:

- 3 percent back on goods or services purchased directly from Apple, including those from Apple’s online and retail stores, iTunes, Apple Music and other Apple-owned properties.

- 3 percent daily cash back earned at select retailers, which currently include Duane Reade, Mobil, Panera Bread, Uber, Walgreens, Ace Hardware, Exxon, Nike, T-Mobile and Uber Eats.

- 2 percent back on Apple Pay purchase transactions

- 1 percent back on everything else

The Apple Card, issued by Goldman Sachs, was built to work with Apple Pay. But in cases where you shop with an app or on a website that doesn’t accept Apple Pay, you get a virtual card number that works in the Wallet app. This card is also a Mastercard, so it is accepted anywhere Mastercard is accepted around the world.

The Apple Card comes with an average variable interest rate range of 19.24 percent to 29.49 percent, but it can help you pay less in interest by estimating how much you’d pay for a particular purchase and suggesting a payment amount to help you pay off balances faster. As with most credit cards, you can avoid interest entirely by paying off your entire balance each month.

Apple Card users can also access an exclusive high-yield savings account with Goldman Sachs. Once you’ve created an Apple Savings account, your Daily Cash rewards will automatically be added to your savings account, which offers an APY of 4.40 percent. There are no minimum deposit or balance requirements and you can withdraw your rewards at any time without paying a fee.

That said, the Apple Card is more limited than other credit cards, as rewards redemption options are limited — after all, the card is designed for Apple enthusiasts, and the rewards are aimed at keeping you that way.

How does the Apple Card cashback work?

When you get cash back with the Apple Card, you’re rewarded in the form of daily cash. Mostly, the term “Daily Cash” is only used to describe the amount you have earned in your bonus account. Unlike other cashback credit cards that award you once a month when your credit card statement closes, Daily Cash accrues every day as you earn them.

As daily cash accrues, it will automatically be added to your Apple Cash account or Apple Savings account (if you have one). Apple Cash is a component of Apple Pay that allows you to maintain a cash balance that you can use to make purchases or send money to friends, among other options. For example, when you shop with Apple Pay and have a balance in your Apple Cash account, you can use it to pay for purchases instead of using another form of payment linked to your account.

How to find your daily cash

Finding your daily cash is easy. Simply unlock your iPhone, open the Wallet app, and select your Apple Card. Then tap the three dots in the top right corner and select Daily Cash. This is where you can see how much Daily Cash you’ve earned, where they deposit to and any special offers.

EXPAND

Your daily cash doesn’t expire or lose value, so you’ll find it in one of three places you can choose to leave it:

- In your Goldman Sachs savings account.

- In your Apple Cash, from where you can transfer it to your bank account.

- Accumulates on your Apple card (if you haven’t set up the other two options).

If you haven’t set up any of these options, Daily Cash continues to grow and can be redeemed as a statement on your Apple Card, which counts as a payment.

Bank course insight

It’s important to note that if you choose to deposit your Daily Cash into Apple Cash, this balance will be combined with any other Apple Cash you’ve received. For example, if someone sent you $25 in Apple Cash to cover their half of lunch and you deposited $1 in Daily Cash, you would see a balance of $26.

How to change the destination of your daily cash

Want to change where your daily cash is sent to? Take the same steps as finding your daily cash and look under the Daily Cash heading. As long as you have Savings or Apple Cash set up, you can just tap on the one you want to change it to. It typically takes at least one business day for your choice to take effect. The one you have successfully selected will have a blue tick next to it.

EXPAND

If you choose to send it to savings, you will earn interest on your balance. But if it’s set to contribute to your Apple Cash balance, you can use it to make purchases and send money to people you know. Choose the way that works best for your purposes and switch it up whenever you want.

What can you redeem Apple Card Daily Cash for?

You can use your daily cash rewards to:

- Purchase of goods via Apple Pay

- Send money to friends

- Paying off your credit card balance

- Increase your savings in a high-yielding Apple Savings account

When you use your cash back to make purchases through Apple Pay, the possibilities for redeeming your cash back rewards are almost endless, as you can use Apple Pay anywhere it’s accepted – in grocery stores, shops, restaurants and more.

EXPAND

You can also use Apple Cash to make purchases in iTunes, Apple Music, the App Store, iCloud and Apple News+.

Pros and cons of the Apple Card cashback program

While the Apple Card offers some generous benefits and rewards, it’s not for everyone. In fact, you need to be an Apple customer to get the most out of this cashback credit card. To access and use all of Apple Card’s features, you must add your Apple Card “to an eligible iPhone or iPad that you own with the latest version of iOS or iPadOS,” according to Apple.

To help decide if the Apple Card rewards program is right for you, consider these additional pros and cons:

Benefits

- Up to 3% rewards rate is higher than the rates offered by many cashback cards

- No hidden fees like annual fee, late fees or foreign transaction fees

- Cash back rewards are earned daily in the form of daily cash

- Cash back can be automatically deposited into a high-yield savings account that earns 4.40 percent APY

- Free laser-etched titanium card upon request

Disadvantages

- Must use Apple Pay to get the best reward rates

- No way to redeem your rewards directly for options like gift cards or travel

- Rewards are mixed with your Apple Cash balance, which may not be ideal if you’re saving money back for a specific redemption

- No welcome offer or balance transfer offer

Is Apple Card’s cashback program worth it?

If you’re a devoted Apple customer who makes a lot of purchases with the brand and already uses Apple Pay, the Apple Card and its rewards program might be a good fit for how you already spend money. But if you don’t have an Apple device and don’t plan on getting one, this card and its rewards program will be of little value to you.

Ultimately, the Apple Card is best for consumers who already operate in the Apple universe and who mostly want to redeem their rewards for purchases or for account credits or deposit their rewards into a high-yield savings account.

Bottom line

While the Apple Card may be ideal for Apple enthusiasts, don’t forget to compare it to other options out there. There are still plenty of top rewards credit cards that allow you to earn a similar rate of rewards in popular bonus categories. Additionally, these cards’ reward structures won’t be tied to your mobile device, and you may have more opportunities to redeem rewards.

As always, you should compare credit card offers you’re considering in terms of rewards rates, benefits, welcome offers and fees before choosing a card.

*The information about the Apple card has been collected independently by Bankrate. The card information has not been reviewed or approved by the card issuer.